Retail Point of Sale System Buyers’ Guide

No matter where you are in your purchasing journey, it doesn’t hurt to have some advice along the way. If you’re in search of a point of sale system for your retail business, you’re in luck!

Whether POS Nation is the best choice for your business or not, our team has put together a buyers’ guide to help you make important decisions about your point of sale (POS) solution.

Step 1: Think About What You Want Your POS System to Do

This may be surprising, but many people we speak to aren’t sure why they want a point of sale system. Before talking to providers, we recommend doing a quick brainstorm exercise.

Start thinking about what you want a POS system to do for your business and write it all down. A basic point of sale system runs transactions — start from there and add the features you want. Think about the core functions of your business and the workflow around them.

What Are Your Current Pain Points?

- Inventory - How do you track and update the products you have on hand?

- Customers - How is customer data used? What information do you keep?

- Reports - What reports do you use to run your business?

- Loyalty Programs - Do you want to reward repeat customers?

- Purchasing - How do you issue purchase orders to your vendors? How do you know what products to buy?

- Discounts - How do you run promotions and accept coupons?

- Security - How do you monitor employees? How safe are your transactions?

Be sure to ask your employees about features, too. Naturally, small workflow problems can build up over time and go unnoticed by management. It’s important to collaborate with the people who are using your system on a daily basis.

Step 2: Decide Which Type of Software Is Best for Your Business

Once you have an idea of what you want your POS system to do for you, your next focus should be deciding if you want cloud-based or server-based POS software. Simply put, cloud-based stores your data in the cloud while server-based software stores your data on a local computer.

YES

NO

- Do you participate in pop-up shops, flea markets, or other events that require you to be mobile?

- Do you want the ability to work from different locations at any time?

- Are you always on the go for your business?

- Would you prefer automatic software updates as opposed to scheduling a technical support appointment for routine maintenance?

If you answered ‘yes’ to any of the questions above, then cloud-based software is likely the best choice for your small business.

Here are some other ways local database and cloud-based software differ:

Local Database Software

- Business data is stored on your local computer

- You may have the option to purchase software upfront so that you own your license.

- No internet connection is necessary for running transactions.

Cloud-Based Software

- All business data can be accessed remotely so you can work from home.

- Software is subscription-based, and typically paid for monthly. You do not own it.

- Internet is required for sales (although many cloud solutions have an offline mode in case of emergency).

In general, one software type isn't "better" than the other — they just offer different features and flexibility for your business. The choice you make depends on what makes the most sense for you.

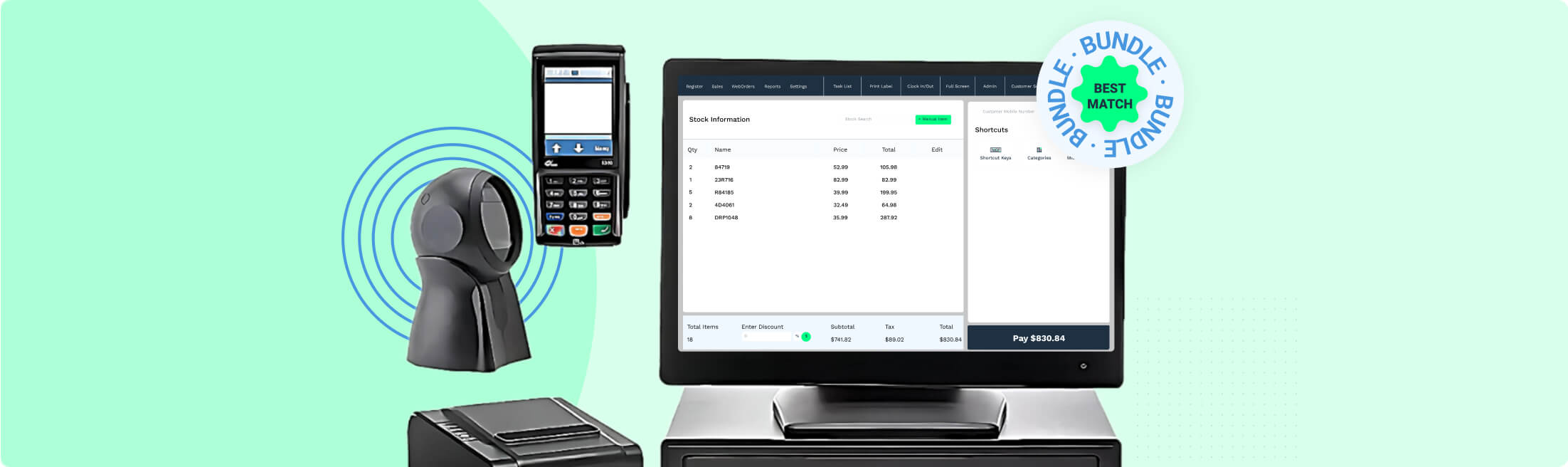

Step 3: Figure Out What Equipment You’ll Need

There are hundreds of add-on devices available for point of sale systems. The most basic retail setup includes an all-in-one computer, receipt printer, barcode scanner, and cash drawer. A customer display, barcode printer, and pinpad are commonly added to this setup. We’ve outlined some details on these devices below.

- Receipt Printers — Direct thermal technology is used to print receipts. Basically, this means that the text is burnt into the paper. Receipt printers are fast, quiet, and don’t require any ink ribbon refills. One should accompany each station.

- Barcode Scanners — Scanners read barcodes using single-line or omnidirectional scanning technology. Single-line is less expensive, but barcodes have to be lined up correctly or they won’t scan. Omnidirectional costs more, but barcodes can be read at any angle. Scanners can be wireless or programmed to scan IDs.

- Cash Drawers — Technology is always changing, but the one constant in the POS world is a strong metal box for securing cash. A cash drawer should be part of every station you use to complete transactions.

TIP: Most point of sale vendors will try to upsell you with add-on devices. You won’t need most of them, which is why it’s important to go into a conversation knowing exactly what you want.

- Barcode Printer — If you sell merchandise that doesn’t come with barcodes, having a barcode printer allows you to print custom labels in a variety of shapes and sizes. While non-barcoded items can be entered into a POS touchscreen menu, larger, and more expensive items can benefit from a printed barcode.

- Customer Displays — Customer displays, or pole displays, allow customers to see the item and price being rung up by the cashier. Displays come with colored LCD screens or dot matrix (“old school” black and green) and can be placed on a pole or mounted to the back of the POS system.

- Pinpads — You need a pinpad to accept chip cards, debit cards, and EBT. If your customers regularly spend more than $20, having a pinpad may help lower your total credit card processing fees. Pinpads can also help you accept mobile payments.

There are scales, tablets, and many more add-ons than what we highlight here. To dive in deeper, check out our guide to point of sale hardware!

Step 4: Set Your Budget

Not only do you need a budget, but you also need to decide if you’d prefer an upfront purchase or monthly payments. You have options!

Upfront Purchase

- $1,200 to $3,000 in full for a single point of sale system. Cost varies depending on the software, hardware, and provider.

- Cheapest option if you look at the total cost of ownership over the life of the system, but you may need to pay for and schedule regular updates.

Monthly Subscription

- Like leases, pay a monthly cost for the entire point of sale system and you do not own the software license or hardware.

- Lowest upfront payment plus the most flexibility. Some providers do not have cancellation fees or long-term contracts (POS Nation included).

- Your subscription may include perks. (POS Nation offers free hardware upgrades every few years!)

TIP: You may come across companies that claim their point of sale system is free, but there are no free systems on the market. These misleading offers typically require monthly or quarterly payments, long-term credit card processing contracts, and even personal guarantees for all payments over the life of the contact. “Free” solutions can be the most expensive over the life of the POS system, so be cautious.

Step 5: Do Research and Make Calls

By now you should have a good idea of the features, hardware, and payment method you’ll want. Now it’s time to start talking to different POS companies.

Go through your list of needs to see if the company’s solution will do what you need it to. Tell the sales rep about your workflow and how you want your system set up. Ask about the hardware you want and confirm the solution is compatible with it. See what payment methods are available, too — some companies have options while others do not.

Must-ask Questions to Get Past the Sales Pitch

- Can you outline all of the ongoing fees associated with your proposal?

- Are your support technicians your employees or are they outsourced? Is your support team available 24/7?

- Do you provide one-on-one training? Is training an additional cost?

- What services do you offer to help me get up and running? Can you import my inventory? Do you offer on-site installation?

- Is this a complete solution, or do I need to pay extra for additional features that I need?

- If I process credit cards with your preferred payment processor, will I be locked into a long-term contract? Could I switch if I wanted to? Will my rates stay the same or will they go up over time?

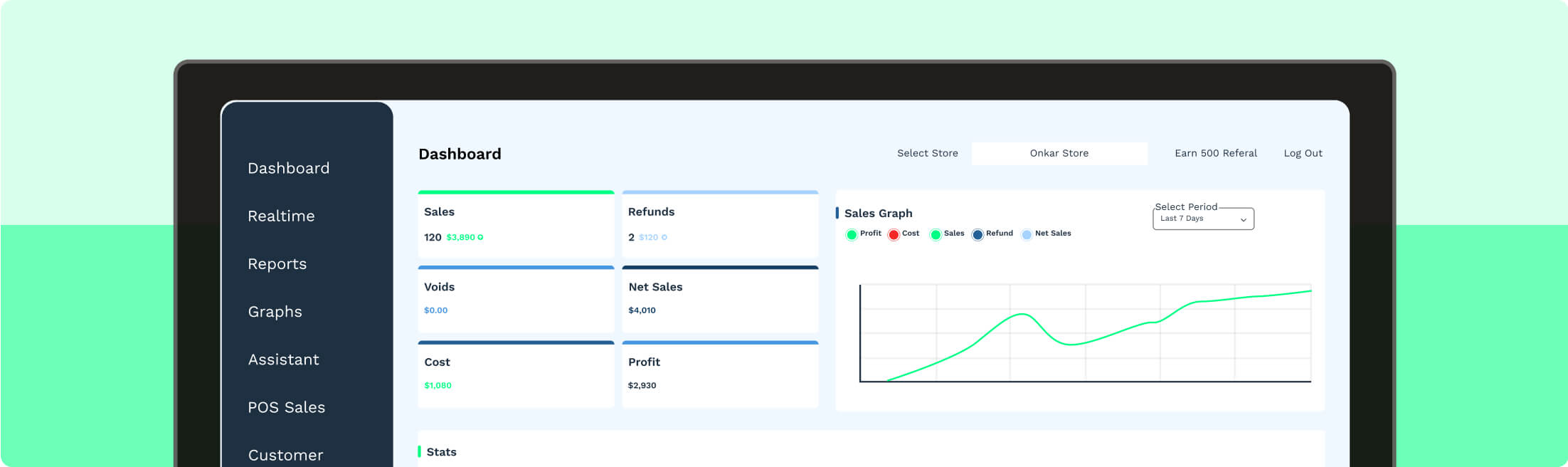

Step 6: Test Drive the Software

Schedule a demo with your sales rep to see the software in action. Most providers will let you download a trial version of the software, but being guided through a live demonstration is extremely beneficial.

In 15 to 30 minutes, you’ll get an idea of whether the system will be a good fit. Your POS software is going to help you run your business. Invest time into a demonstration to ensure you’re making the right decision!

Step 7: Choose a Credit Card Processor

If you’re going to invest in a POS system, we always recommend integrating payment processing. This allows your system to quickly and easily accept credit and debit cards.

The alternative is to use a standalone terminal, which requires you to enter the transaction amount manually and insert the card in an external device. Standalone terminals usually require a long-term contract and can charge credit card fees that are higher than average.

TIP: Try to negotiate with POS companies and see if you can get a discount on your system if you agree to use their processor.

Most POS providers can offer recommendations for payment processors, and some can even quote you for payment processing rates. If it’s an option, bundling your point of sale purchase with payment processing gets you the most bang for your buck. If you use a different company for each, then that just means that both companies will need to make a fair profit on your transaction.

Even if you love your current processor, it doesn’t hurt to ask for a quote and get a comparison. And be sure to pay attention to the details — we’ve talked to several merchants who have been paying fees they had no idea about.

Step 8: Pull the Trigger

Every point of sale system has its strengths and weaknesses. Weigh the pros and cons and take the time to think about what is most important to you and your small business.

If you’ve followed all of the steps in this buyers’ guide and you’re confident you’ve found the perfect solution for your business, make the move!

Complete the purchase, set up your POS system, get trained, and start running your business better than ever.